Navigating Biden’s Proposed Wealth Tax and theSunset of Estate Tax in 2025

The Biden administration has proposed a billionaire’s minimum income tax. However, Biden’s billionaire tax is not a tax on income but on wealth.

The appreciation of assets would be included in the tax base annually regardless of whether they have been sold.

For persons with a net wealth of at least $100 million, capital gains would be taxed annually with a minimum tax of 20% and not when realized.

Net worth over a threshold of $50 million would be subject to a 2% tax, with a surtax of 4% applied to a net worth over $1 billion.

Is a wealth tax feasible?

Most likely not.

A good argument against the wealth tax is the sunset of the estate tax in December 2025.

In 2022 the federal estate tax exemption is $12,060,000 for an individual or $24,120,000 for a married couple. From January 1, 2026, that provision will return to its 2017 amount of $5,000,000, adjusted for inflation.

President Biden also proposed rolling back estate taxes not to the 2017 level but to the 2009 one which the tax exemption would be $3.500,000 (not approved by Congress).

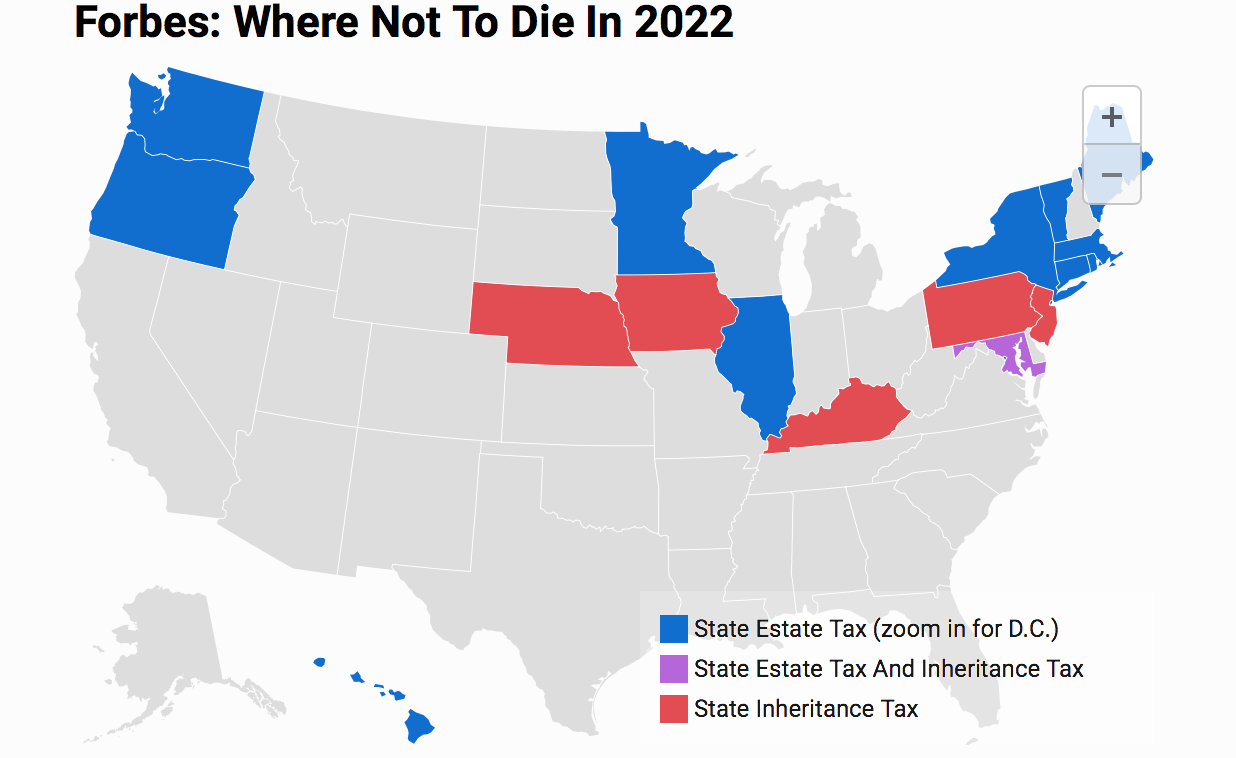

Please remember that some States also tax their residents on Estate tax and or Inheritance tax – as shown.

Consequently, a reasonable argument exists supporting an inheritance tax to reduce generational wealth accumulation.